Starting a franchise is an exciting journey, but finding the right funding solution is a critical first step. Thankfully, there are several financing options available to help entrepreneurs turn their dreams into reality.

In this post, we’ll explore three popular franchise funding methods: Flexible Funding Solutions, SBA loans, and ROBS (Rollover for Business Startups) rollovers, to help you make an informed decision.

1) Flexible Funding Solutions: Tailored Financing for Franchise Success

By choosing a flexible funding solution, you can focus on achieving your franchise dreams with the financial support you need.

Key Features of Flexible Funding Solutions:

-

- Business Acquisition Loans: Support for purchasing a franchise or expanding your portfolio.

- Commercial Real Estate Loans: Ideal for financing property for your franchise location.

- Working Capital Solutions: Access funds to cover startup expenses, equipment purchases, or operational costs.

- Equipment Financing: Helps lease or buy essential franchise equipment.

Why Choose Flexible Funding Solutions?

-

- Creative and Adaptable Options: Tailored to meet your specific business needs.

- Expert Support: Work with professionals experienced in franchise funding.

- Streamlined Process: Simplified application procedures ensure quick access to financing.

Our Recommended Partners

While there are many options available, we recommend exploring Alpine Commercial Funding and Live Oak Bank for their creative and flexible lending options tailored specifically for franchise owners.

Email Franchise Resource so we can provide personalized guidance and ensure a seamless introduction.

2) SBA Loans: A Trusted Choice for Franchisees

Small Business Administration (SBA) loans are a tried-and-true option for franchise funding. These federally-backed loans offer lower interest rates and longer repayment terms, making them a popular choice among entrepreneurs.

Why Consider an SBA Loan?

-

- Affordable Financing: Low-interest rates help keep costs manageable.

- Flexible Terms: Loan durations range from 7 to 25 years, depending on the program.

- Franchise-Friendly: The SBA Franchise Directory ensures eligible franchises meet SBA standards, expediting approval.

Types of SBA Loans for Franchisees:

-

- 7(a) Loan Program: Ideal for franchise purchases, with funding up to $5 million.

- 504 Loan Program: Perfect for financing large purchases like commercial real estate or high-cost equipment.

Pro Tip: Ensure your franchise is listed on the SBA Franchise Directory to simplify the approval process.

3) ROBS Rollovers: Fund Your Franchise with Retirement Savings

A Rollover for Business Startups (ROBS) allows you to leverage your retirement savings to fund your franchise without early withdrawal penalties or taxes. This debt-free funding option is especially appealing to entrepreneurs who want to minimize financial risk.

How ROBS Works:

-

- Roll your retirement funds into a newly created corporation’s retirement plan.

- Use the plan to invest in the corporation, giving you the capital to fund your franchise.

Why Choose a ROBS Rollover?

-

- Debt-Free: No loans or monthly payments required.

- Tax-Advantaged: Avoid penalties and taxes on your retirement savings.

- Quick Access to Funds: Typically completed in a matter of weeks.

Important Consideration:

-

- IRS Scrutiny: ROBS transactions are closely monitored by the IRS, requiring strict compliance to avoid penalties or fines. Working with an experienced provider is essential.

- High Stakes: Using retirement funds to finance your business can create additional stress, knowing your future financial well-being is on the line.

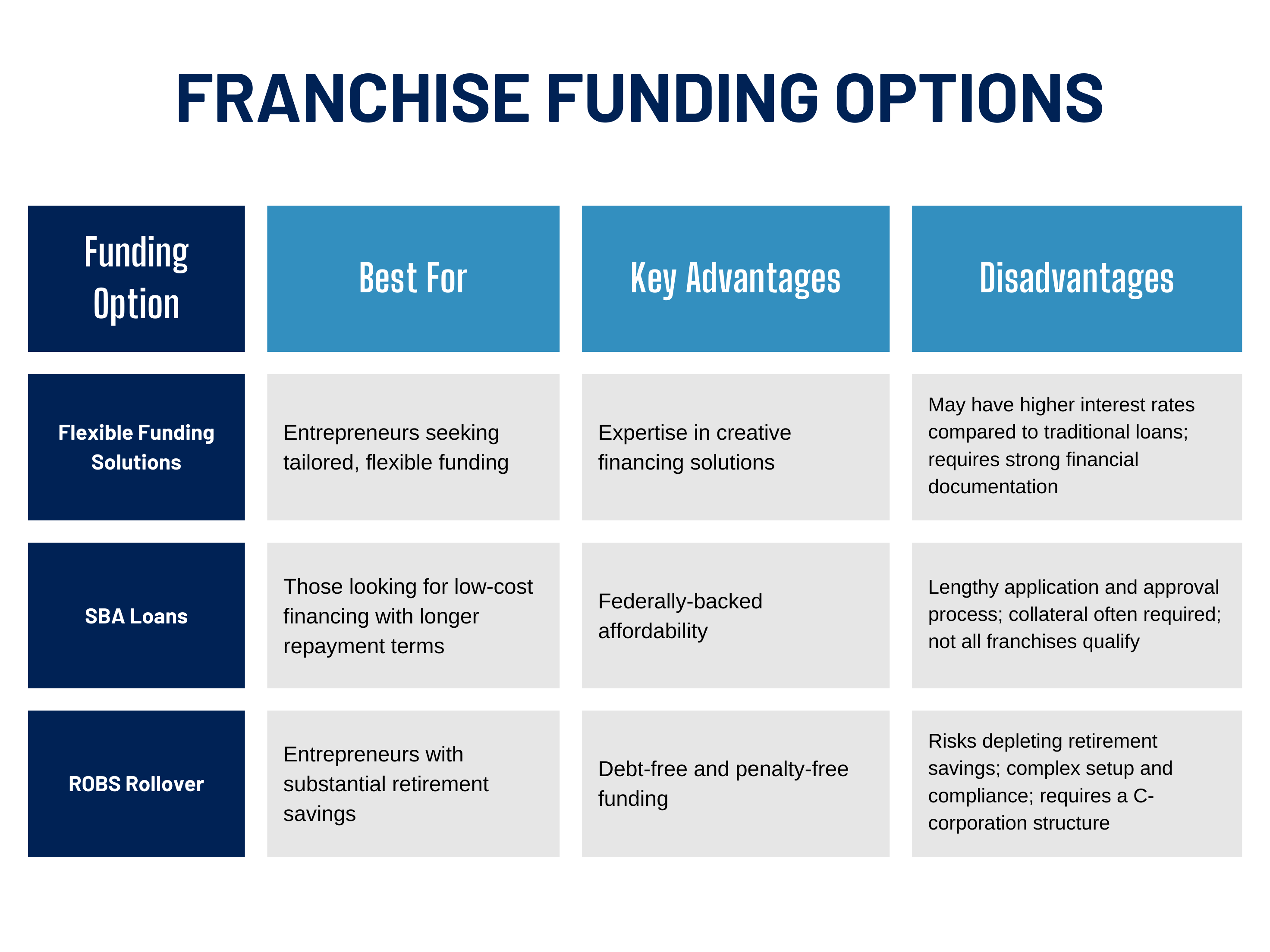

Which Funding Option is Right for You?

Choosing the right funding option for your franchise depends on your financial situation, goals, and long-term business strategy. Below is a quick comparison to help you weigh the benefits and drawbacks of each option:

By carefully evaluating the advantages and disadvantages of each option, you can select a funding solution that aligns with your vision and sets your franchise journey up for success. Consider consulting with financial professionals to make the most informed decision.

Ready to Explore Your Franchise Funding Options?

Choosing the right funding option is a big decision, and we’d love to help guide you in the right direction. No obligation – just helpful expert guidance tailored to your goals!

Email us at hello@franchiseresourcellc.com with the subject line “Franchise Funding Inquiry,” and we’ll get back to you promptly.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered financial, legal, or tax advice. We recommend consulting with a qualified financial advisor, accountant, or legal professional to assess your unique situation before making any funding decisions.

If you need personalized guidance or have questions, feel free to reach out to our team—we’re here to help!

0 Comments